Well, in case you haven't noticed, is once again over 1600$/ounce. This "sudden" move was triggered by the US May Jobs Report, which Marketwatch described as "disappointing":

U.S. stocks sink after disappointing jobs report

Stocks on Wall Street fell sharply on Friday after a disappointing U.S. jobs report and downbeat data from China and Europe raised serious concerns about the health of the global economy.

“Disappointing payroll data in combination with mounting external risks obviously increase the pressure on the Fed to apply further stimulus,” wrote Bernd Weidensteiner, an analyst at Commerzbank AG, in a note, with the euro-zone sovereign debt crisis being the main external risk.So, there is no recovery after all, is there? The US Jobs Report can -and is- be manipulated. Especially during the last few months, the "Bureau of lies and scams" as The Burning Platform nicknamed it has been working overtime in order to persuade us that the recovery is real - here is an article dated 05/04/2012:

HERE WE GO AGAIN – FUN WITH THE BUREAU OF LIES & SCAMS

The employment report from the BLS just hit the wires.

AWESOME NEWS!!!!!!

The unemployment rate FELL to 8.1%. This is the lowest level in years. All hail Obama and his fantastic management of our economy.

So let’s look at how we achieved this reduction in the unemployment rate. Here is a link to the data:

http://www.bls.gov/web/empsit/cpseea03.htm

Here are the facts:

The working age population rose by 180,000 people

The number of employed people DROPPED by 169,000.

Hmmmmm. Wait a second. If there are more working age people in the population and less employed people, a critical thinking individual might wonder HOW THE FUCK did the unemployment rate DROP?

Oh don’t worry your mind over such trivialities. Our friendly drones at the BLS have it all figured out. You see 522,000 Americans willingly decided their lives were so fulfilled and their financial situation was so good, they decided to kick back and leave the work force.

The country has another new record. There are 88,419,000 of us who don’t want or need a job. The participation rate of 63.6% is now at a 30 year low, back to levels before many women joined the workforce.

But wait a minute: IF the government can manipulate the jobs report, why didn't they do it this time around? Well, this is where the plot thickens, as they say. Here's Jesse on the subject:

I looked over the Jobs numbers earlier this morning, and checked the usual suspects. Imaginary additions were 204,000 which are right 'in the groove' for the normal pattern we see for May each year.

If anything the seasonal adjustment was shaded to the downside, meaning that it would have not taken much or been out of the norm to have taken away LESS jobs in the seasonal adjustment, and brought in a report that was in line with expectations.

So why put out a weak number when one could have statistically justified a stronger number? Besides 'sand-bagging' now with an eye to the second half of the year?

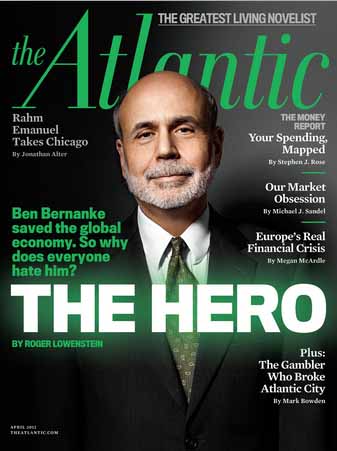

There are an important set of central bank decisions coming up, including the FOMC meeting shortly after the Greek elections at mid month. This weak Jobs number gives Bernanke the cards he needs to play in responding to the evolving crisis.

And you know what that means.

And this is why gold and silver diverged so hard this morning to the upside. They had been artificially pressed down for the May-June contract expirations, and some might say to lessen the impact of their rally when the inevitability of QE became evident.

I am just wondering how the Feds will try and spin it.

Gentlemen, start your presses. But try not to be too obvious about it.It's easy to pin it all to Bernanke and the FED - but as we've explained before, if you really want to find the root of all evil, you'll have to search harder:

In a nutshell, the bankers have been handing out one loan after another, in order to substitute for the industrial capital's flight to Asia: The West's productive base has been shrinking for quite a while now, but the loans handed out out by the bankers have been masking this uncomfortable truth for all these decades So, the multinationals have been getting richer and richer by exploiting the -massively underpaid- Asian workforce, and the banks became bigger and bigger (they are now "too big to fail", and Goldman Sachs's CEO even considers himself as doing God's work - talk about hubris).

But the economy reached a point where the Western worker simply couldn't pay for his mortgage (that's a bit of an over-simplification, but you get the point). So, now the banks are in trouble as well, because if they can't collect the money they were supposed to collect from the recipients of those loans, they are bankrupt (ALL of them). Let's not forget Lehman's collapse, not to mention the hundreds of other (smaller) banks that have gone bankrupt in USA over the last four years.

But, as we all know, most banks are being rescued via your -and my- money. But the banks need a lot of money. Well, I know that they have already received huge bailouts, but that's not enough. Banks are failing in Europe (now it's the Spanish banks, then Greece again, etc) and in USA, stocks are going down, and it seems like everything is about to collapse.

But guess what - no matter how much the banks need, money can be printed in today's economic system - and they will.

States all over the world have been printing money for quite some time now, and they continue to do so. Savings the banks is more important than preserving the value of their currencies, so...they will inflate these currencies. And as more and more people realize this, these currencies will hyper-inflate, as noone will want to trade ("loss of confidence") in a currency that keeps losing value compared to gold, the only thing that will remain stable, as it always does.

[By the way, did you hear about China and Japan's deal to trade with each other in their own respective currencies, instead of using the dollar? Or maybe about China's deal to buy oil from Iran in exchange for yuan, instead of dollars? Oh, and guess what, China and Russia are no longer buying a lot of US bonds, are they? They are however buying gold...]

As for the workers, printing money is a great way for the ruling class to stealthily lower their wages, making them more "competitive". After all, they do have to compete against the dirt-cheap Asian labor-force, don't they? So, they only way to go forward, according to our rulers, is for us to become really poor, and for them to receive huge bailouts, making them even more powerful than they already are. This is the only way they will return to the West for investments - until the workers accept "modern serfdom", the capitalists will simply let them starve. Hunger will take care of the rest. And since our rulers are already doing God's work, they could even declare themselves to be Gods, like the Pharaohs. And why not? Their will is our command, isn't it?

But this process of debasing the currency has to be completed "one step at a time". If they print everything at once, everyone will be on to them, and things will get out of hand. So, they first let the stock market almost crash, and then they "save the day", by printing more and more money. This has already happened a lot of times, and it will probably continue to happen in the future, in both USA and in Europe (Europe is an even more complicated case, since it is a monetary union of many different States: Germany is letting everyone else crash, and only then they allow the ECB to print money (in order to save the German banks among others). But before Germany agrees to money printing, they always hold a conference, where they propose a few new treaties, that give them more and more control over their