Sorry for not posting during the last few days, but i had to deal with a medical emergency (my mother was in the hospital), so there was no time for me to write. I will resume writing about China, in the third and final post on the subject, where we shall discuss China's moves on the monetary plain, as it seeks to end the dollar's rain as the world reserve currency.

But for now, let's talk about something else - let's talk about my sick mother who went to the hospital and got better:

You see, if you get sick, you can (?) go to the hospital and get well. But what happens if you you have no or little money? Then you obviously or you are forced to carry this medical problem/injury for a long time, maybe even forever.

Not everyone is supposeed to make it - in fact the system relies on NOT everyone making it, as it tries to rationalize why a lot of people "should" die (mass murder) just because they were born in poverty, or because they just happened to be born during a war or a generalized capitalistic crisis.

The system has been very good at "rationalizing" this muss murdering process for a long time - in fact, there are many people who are genuinly surprised that the capitalist system is now leading them to their death or to mass poverty, as they don't even understand that this is not a failure of the system, but a necessary process for it to continue to function.

Think of it like monopoly:

Monopoly is a great simulation board game for the capitalist system, as it is based on the concept of private property (of course, the real thing is much more complicated than the board game).

In the early stages of the game, all the little squares of the board that represent streets, airports, the electric company, etc., are for sale. So, all the players can buy them. It's fun, isn't it?

But as game progresses, then sooner or later a few players (those who are luckier and/or better investors) will end up owning almost everything, forming powerful monopolies/oligopolies. As for the rest of the players, they end up going bankrupt one by one, as they own less and less, and they have to pay rent to the rich players on almsost every turn, as the rich players end up owning all the squares of the board. This is NOT a "failure" of the game, it is in fact its purpose. I mean, how can you play monopoly without bankrupting most of the players? It is simply not possible, and it is only a matter of time before it happens.

Real-life capitalism is of course a great system for creating new, better "squares" in order to replace the older ones, especially through technological advances (for example, M. Zuckerberg created Facebook, an entirely new "square in the board" and he now earns a lot of money ("rent") as everyone wants to use it).

So, the real-life "board" is constantly changing, and it does provide opportunities for someone to create a new "square". This makes the real-life game much more "interesting", and it also helps in delaying the inevitable bankruptcy of a lot of people. But, especially it times like these, when there aren't a lot of new "squares" being created, the process of bankrupting a lot of players cannot be stopped. It is the nature of the game - a lot of players must go bankrupt, so that a few oligarchs can own everything.

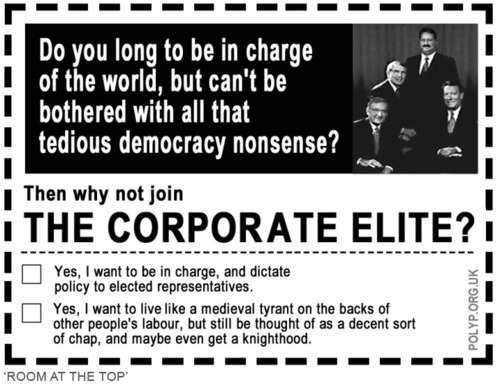

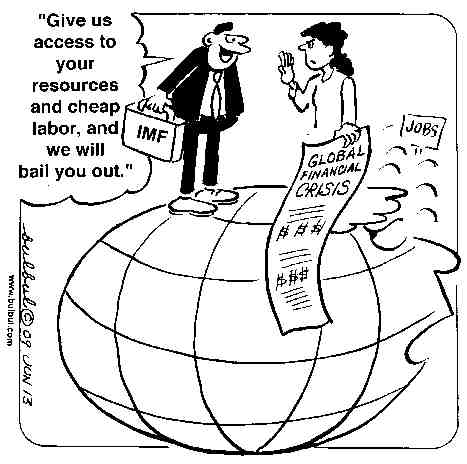

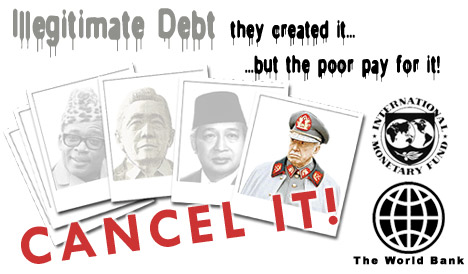

Sure, there are plenty of squares to go around for everybody - in fact, this is what marxism is all about: Abolishing private property, as it is the only way for the working class people, the majority of the population, to actually be able to produce without having to live in poverty, when at the same time a few oligarchs are living like kings. And, surprise surprise, they seem to prefer it of the workers live in poverty, just like the oligarxhs of the past, the oligarxhs they once violently overthrew during the Frech Revolution. Capitalism has created a lot of wealth, enough for everyone - and we whould praise capitalism for this great achievement. But capitalism has also helped a tiny minority of the population to control almost all the squares of the board. So, most of us will have to suffer greatly, or we have to abolish private property, so that all the squares of the board are free for everyone. This will of course NOT go down well with the oligarxhs, who will never accept this. But if they are not aliminated by us, then a lot of us WILL be elimited by them. This is a process that is becoming increasingly clear as time goes by. And let's not forget this very important fact: In the earleier stages of the "game", the palyers that were eliminated were usually people from the poorer countries (Third world countries, etc.). But now that the global workforce also includes the Asian workers, there are a lot of Western people who are deemed "not-competitive". So, for the first time in years, a lot of the people that are going bankrupt are Westerners, not just "unimportant" people from "unimportant" places.

Let's take a closer look at what it takes for a worker to be "competivie enough" to stay in the game and not go bankrupt. After all, the capitalists want us to give them incentives to do business in the West, instead of Asia, right? So, it would be a good idea to check out what is it about the Asian workers that they like so much:

How's

Read more »

But for now, let's talk about something else - let's talk about my sick mother who went to the hospital and got better:

You see, if you get sick, you can (?) go to the hospital and get well. But what happens if you you have no or little money? Then you obviously or you are forced to carry this medical problem/injury for a long time, maybe even forever.

Not everyone is supposeed to make it - in fact the system relies on NOT everyone making it, as it tries to rationalize why a lot of people "should" die (mass murder) just because they were born in poverty, or because they just happened to be born during a war or a generalized capitalistic crisis.

The system has been very good at "rationalizing" this muss murdering process for a long time - in fact, there are many people who are genuinly surprised that the capitalist system is now leading them to their death or to mass poverty, as they don't even understand that this is not a failure of the system, but a necessary process for it to continue to function.

Think of it like monopoly:

Monopoly is a great simulation board game for the capitalist system, as it is based on the concept of private property (of course, the real thing is much more complicated than the board game).

In the early stages of the game, all the little squares of the board that represent streets, airports, the electric company, etc., are for sale. So, all the players can buy them. It's fun, isn't it?

But as game progresses, then sooner or later a few players (those who are luckier and/or better investors) will end up owning almost everything, forming powerful monopolies/oligopolies. As for the rest of the players, they end up going bankrupt one by one, as they own less and less, and they have to pay rent to the rich players on almsost every turn, as the rich players end up owning all the squares of the board. This is NOT a "failure" of the game, it is in fact its purpose. I mean, how can you play monopoly without bankrupting most of the players? It is simply not possible, and it is only a matter of time before it happens.

Real-life capitalism is of course a great system for creating new, better "squares" in order to replace the older ones, especially through technological advances (for example, M. Zuckerberg created Facebook, an entirely new "square in the board" and he now earns a lot of money ("rent") as everyone wants to use it).

So, the real-life "board" is constantly changing, and it does provide opportunities for someone to create a new "square". This makes the real-life game much more "interesting", and it also helps in delaying the inevitable bankruptcy of a lot of people. But, especially it times like these, when there aren't a lot of new "squares" being created, the process of bankrupting a lot of players cannot be stopped. It is the nature of the game - a lot of players must go bankrupt, so that a few oligarchs can own everything.

Sure, there are plenty of squares to go around for everybody - in fact, this is what marxism is all about: Abolishing private property, as it is the only way for the working class people, the majority of the population, to actually be able to produce without having to live in poverty, when at the same time a few oligarchs are living like kings. And, surprise surprise, they seem to prefer it of the workers live in poverty, just like the oligarxhs of the past, the oligarxhs they once violently overthrew during the Frech Revolution. Capitalism has created a lot of wealth, enough for everyone - and we whould praise capitalism for this great achievement. But capitalism has also helped a tiny minority of the population to control almost all the squares of the board. So, most of us will have to suffer greatly, or we have to abolish private property, so that all the squares of the board are free for everyone. This will of course NOT go down well with the oligarxhs, who will never accept this. But if they are not aliminated by us, then a lot of us WILL be elimited by them. This is a process that is becoming increasingly clear as time goes by. And let's not forget this very important fact: In the earleier stages of the "game", the palyers that were eliminated were usually people from the poorer countries (Third world countries, etc.). But now that the global workforce also includes the Asian workers, there are a lot of Western people who are deemed "not-competitive". So, for the first time in years, a lot of the people that are going bankrupt are Westerners, not just "unimportant" people from "unimportant" places.

Let's take a closer look at what it takes for a worker to be "competivie enough" to stay in the game and not go bankrupt. After all, the capitalists want us to give them incentives to do business in the West, instead of Asia, right? So, it would be a good idea to check out what is it about the Asian workers that they like so much:

Cage dogs of Hong Kong: The tragedy of tens of thousands living in 6ft by 2ft rabbit hutches - in a city with more Louis Vuitton shops than Paris

Hong Kong, one of the world's richest cities, is abuzz with a luxury property boom that has seen homes exchanged for record sums.

But the wealth of the city has a darker side, with tens of thousands priced out of housing altogether and forced to live in the most degrading conditions.

These pictures by British photographer Brian Cassey capture the misery of people - some estimates put the figure as high as 100,000 - who are forced to live in cages measuring just 6ft by 2 1/2ft.And if that isn't enough, you should definately check out Jon Stewart's latest video from "The Daily Show", about the Chinese workers at Foxconn:

Unscrupulous landlords are charging around US$200 a month for each cage, which are packed 20 to a room, and up to three levels high. Cockroaches, wall lizards, lice and rats are common.

How's

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Fear Factory | ||||

| ||||