As we all know the West is on the verge of launching an attack against Iran: The Americans have been talking about it for years, trying really hard to look Ahmadinejad look like the bad guy (granted, that's not the hardest thing in the world to accomplish). As for the Israelis, America's watchdog in that area, they would have already launched an attack if they could. There are NATO military bases all around Iran, and Iran's nuclear program is a great excuse for the West to invade them (after all, they invaded Iraq using Saddam's "weapons of mass destruction" as an excuse, even though these weapons never existed. Excuses, unlike facts, are always easy to come by if you truly want to find them).

Anyway, Iran is not an easy target: It has much greater defensive capabilities than Iraq or Libya, not to mention the fact that it has an alliance with Russia and China (who are opposing an invasion - a Chinese military officer even threatened the West with full-scale war if they attack Iran). Iran also controls the Strait of Hormuz, a naval passage of huge importance, as the oil tankers have to cross it to bring the oil to the West. So, if Iran gets attacked, they are threatening to close it down, causing a shortage of oil and a huge spike in its price. This is not bad of course if you are an exporter of oil (like Russia), but it will obviously have devastating consequences for the economies of the West.

Of course, you probably already know most of this stuff - so in this post we're going to talk about the history of oil, and how it is linked to the dollar and the monetary system in general.

After all, everyone knows what the oil states are exporting to the West: They are exporting oil, the world #1 source of energy. That's pretty important, right? But what are they getting in return? They are getting paid in dollars, so in order to truly understand "how the world works", it would be a good idea to see what this "dollar" really is.

This will provide us with a much better understanding of the world economy, and it will also help us understand why the world is heading towards a new "oil crisis", one that will be much bigger than the one we experienced back in the 70's.

The current monetary system, with the dollar as its reserve currency, was born during the Bretton Woods agreement, which was signed right after the end of the Second World War. All the countries had been bombed, even the ones that where on the winning side. Moreover, they all had large budget deficits, as they had to borrow heavily in order to fund their war efforts. But the USA was not bombed, and its economy was almost intact. The factories were working, and its exports accounted for more than 50% of the world's exports. So, they were by far the strongest nation (at least in the West - Soviet Union was pretty strong but they followed a different path), and they were also the world's creditor nation. So, they imposed their will on everyone else - here's something from wikipedia on the subject:

U.S. allies—economically exhausted by the war—accepted this leadership. They needed U.S. assistance to rebuild their domestic production and to finance their international trade; indeed, they needed it to survive.It gets better:

One of the reasons Bretton Woods worked was that the US was clearly the most powerful country at the table and so ultimately was able to impose its will on the others, including an often-dismayed Britain. At the time, one senior official at the Bank of England described the deal reached at Bretton Woods as “the greatest blow to Britain next to the war”, largely because it underlined the way in which financial power had moved from the UK to the US. (source: Business Spectator_

A devastated Britain had little choice. Two world wars had destroyed the country's principal industries that paid for the importation of half the nation's food and nearly all its raw materials except coal. The British had no choice but to ask for aid. Not until the United States signed an agreement on December 6, 1945 to grant Britain aid of $4.4 billion did the British Parliament ratify the Bretton Woods Agreements

What do all these things have to do with oil? Patience dear reader, the answers are coming.

In theory the reserve currency would be the bancor (a World Currency Unit that was never implemented), suggested by John Maynard Keynes; however, the United States objected and their request was granted, making the "reserve currency" the U.S. dollar. This meant that other countries would peg their currencies to the U.S. dollar, and—once convertibility was restored—would buy and sell U.S. dollars to keep market exchange rates within plus or minus 1% of parity. Thus, the U.S. dollar took over the role that gold had played under the gold standard in the international financial system. (Rogue Nation, 2003, Clyde Prestowitz)

Meanwhile, to bolster faith in the dollar, the U.S. agreed separately to link the dollar to gold at the rate of $35 per ounce of gold. At this rate, foreign governments and central banks were able to exchange dollars for gold. Bretton Woods established a system of payments based on the dollar, in which all currencies were defined in relation to the dollar, itself convertible into gold, and above all, "as good as gold".

The only currency strong enough to meet the rising demands for international currency transactions was the U.S. dollar. The strength of the U.S. economy, the fixed relationship of the dollar to gold ($35 an ounce), and the commitment of the U.S. government to convert dollars into gold at that price made the dollar as good as gold.

The U.S. dollar was the currency with the most purchasing power and it was the only currency that was backed by gold. Additionally, all European nations that had been involved in World War II were highly in debt and transferred large amounts of gold into the United States, a fact that contributed to the supremacy of the United States. Thus, the U.S. dollar was strongly appreciated in the rest of the world and therefore became the key currency of the Bretton Woods system.

Another view is that in the time of discount banks, discount was the interest earned on gold, and that the only way to repay interest on government bonds is by printing more dollars, thus raising the price of gold. If gold is fixed at $35 then other countries will demand gold and not accept dollars. The closing of the gold window in 1971 was the result.

A second structural change that undermined monetary management was the decline of U.S. hegemony. The U.S. was no longer the dominant economic power it had been for more than two decades. By the mid-1960s, the E.E.C. and Japan had become international economic powers in their own right. With total reserves exceeding those of the U.S., with higher levels of growth and trade, and with per capita income approaching that of the U.S., Europe and Japan were narrowing the gap between themselves and the United States.

When the dollar become the world's reserve currency, the USA were ruing huge trade surpluses, and they also owned a lot of gold to back the dollar up. Keynes's proposal of a world reserve currency was dismissed, as there was a state that could impose its will on all the others, the USA.

But as other countries, such as Germany and Japan, rebuilt their productive bases, USA had to face a lot of competition, and they weren't running such huge trade surpluses anymore. Furthermore, as Triffin pointed out in what became known as "the Triffin dilemma", owning the world's reserve currency meant that the USA would have to make a choice:

A) They could continue to print new dollars in order to meet the ever-increasing demand (as everyone wanted dollars in order to do business transactions and store his wealth). This would provide the global economy with enough liquidity to continue to grow, but the result is obviously inflation (devaluation of the dollar).

OR

B) They could stop printing new dollars, in order not to [hyper]inflate the dollar. That however would have devastating results for world trade, as the dollar is what the world uses as a means of transaction.

The U.S. chose to print money, and during the Vietnam war in the Nixon years, they needed a lot of new dollars in order to fund it. So, they printed even more dollars.

But remember what we said earlier: The dollar was linked to gold at a fixed rate.

But gold remains stable - so the 35$/ounce exchange rate could not be kept stable anymore, as the dollar was constantly being devalued. So, Nixon decided to end the gold standard, and print as many dollars as the USA wanted.

Here's a video of Nixon's public announcement of this policy - if you listen to him, you will see that he is blaming the "evil speculators" who are for some "unknown reason" attacking the economy of the USA. Not that i like the speculators myself, but they are of course not "evil", nor "psychopaths". They simply want "to make a profit", no matter the cost, and when they realized that gold's true value was greater than 35$/ounce, they started demanding gold instead of dollars. The most notable example of this was De Gaulle's preference of gold over dollars (De Gaulle was the president of France). Here's a link to an article from the Times of that period (Feb. 12, 1965) for those of you we wish to know more. De Gaulle even called for a new, international reserve currency to replace the dollar, and he thought of gold as the "centre" of this new monetary system.

A few years later, things got even uglier for the dollar:

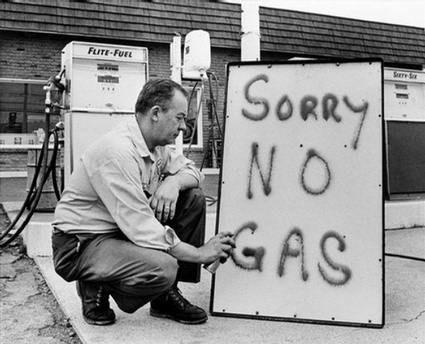

Nixon abolished the gold standard in 1971. Two years later, in 1973, the world was shocked by an"oil crisis", as the oil states stopped accepting the dollar as a means of payment, and demanded gold instead. This is why the gas station depicted in the photograph above had "no gas" during that time. Here's wikipedia on the subject:

US off the Gold Exchange Standard (whereby only the value of the US dollar had been pegged to the price of gold and all other currencies were pegged to the US dollar), allowing the dollar to "float".Today, these "long forgotten" problems are resurfacing, as everyone is engaged in massive "money printing" - and the oil states are not happy about it. The USA managed to overcome the oil crisis of 1973, but know their productive base is much worse off, and the money printing has intensified, in order to bail out the banks and impoverish the workers.

Shortly thereafter, Britain followed, floating the pound sterling. The industrialized nations followed suit with their respective currencies. In anticipation of the fluctuation of currencies as they stabilized against each other, the industrialized nations also increased their reserves (printing money) in amounts far greater than ever before. The result was a depreciation of the value of the US dollar, as well as the other currencies of the world. Because oil was priced in dollars, this meant that oil producers were receiving less real income for the same price. The OPEC cartel issued a joint communique stating that forthwith they would price a barrel of oil against gold.

This led to the "Oil Shock" of the mid-seventies. In the years after 1971, OPEC was slow to readjust prices to reflect this depreciation. From 1947-1967 the price of oil in U.S. dollars had risen by less than two percent per year. Until the Oil Shock, the price remained fairly stable versus other currencies and commodities, but suddenly became extremely volatile thereafter. OPEC ministers had not developed the institutional mechanisms to update prices rapidly enough to keep up with changing market conditions, so their real incomes lagged for several years. The substantial price increases of 1973-74 largely caught up their incomes to Bretton Woods levels in terms of other commodities such as gold.

But as the oil crisis of 1973 has proven, there is at least one powerful force amongst the imperialists that does not like money printing: The oil states. Moreover, Russia and China are obviously also not in favour of the USA - they too want the dollar's reign to end. We shall talk about their moves, and also about Europe's moves and the euro in future posts.

For now, let's just say that as the dollar -and the rest of the fiat currencies- are losing their value due to money printing, we are approaching a point where the world will simply reject them, and the West will not be able to have oil - at least not at "reasonable" prices by today's standards.

This is why the USA "must" attack all the oil states who try to break free from the dollar, and start accepting other means of payment - because no mater how much it costs them to go to war, it will cost them a lot more if the world finally gets of the "dollar standard", and the value of the dollar goes to almost zero.

The main thing that prevents the oil states from rejecting the dollar right now is their fear of being attacked by the USA - if that fear goes away, then they will be free to choose what currency to accept as means of payment.

Here is a brief history of the oil states that the USA has attacked (or is about to attack) over the last 10 years - these states all tried to "move away" from the dollar:

Back in 2000, Iraq began selling oil for euros, and they even made a profit, as the euro appreciated against to the dollar. Here's an article from "the Guardian":

Iraq nets handsome profit by dumping dollar for euro

A bizarre political statement by Saddam Hussein has earned Iraq a windfall of hundreds of million of euros. In October 2000 Iraq insisted on dumping the US dollar - 'the currency of the enemy' - for the more multilateral euro.After this move by Saddam, the USA invaded Iraq and one of the first things they did when they destroyed him, was to force Iraq to sell its oil for dollars, not euros. They also hung Saddam Hussein, in order to show to the world what would happen if they even tried to get away from the dollar.

Almost all of Iraq's oil exports under the United Nations oil-for-food programme have been paid in euros since 2001.

But a few years later, another "crazy" guy appeared, and he didn't seem to like the dollar either:

Here is an article from Reuters, published in 2007:

Iran stops selling oil in U.S. dollars -report

For nearly two years, OPEC's second biggest producer has been reducing its exposure to the dollar, saying the weak U.S. currency is eroding its purchasing power.Ahmadinejad is no saint, but he is right: the weak U.S. currency is eroding the dollar's purchasing power, and this is why he doesn't like it. I am not sure if the USA can handle Iran, Iraq and Afghanistan at the same time: Three war fronts is a lot to handle, especially if you are "an empire in decline". Maybe this is why the Americans left Iraq - in order to allocate more resources to Iran. But even if one oil state is allowed to reject the dollar, the USA is finished, as the others will quickly follow suit. This is why the Americans want to invade Iran. And it also one of the main reasons the the recent NATO invasion in Libya:

Iranian President Mahmoud Ahmadinejad, who often rails against the West, has called the U.S. currency a "worthless piece of paper."

Nozari told ISNA: "In regards to the decrease in the dollar's value and the loss exporters of crude oil have endured from this trend, the dollar is no longer a reliable currency."

"This is why, at the meeting of the heads of states, Iran proposed to OPEC members that a currency (for oil exports) would be determined that would be reliable and would not cause any loss to exporter countries," he said.

Saving the world economy from Gaddafi

Some believe it is about protecting civilians, others say it is about oil, but some are convinced intervention in Libya is all about Gaddafi’s plan to introduce the gold dinar, a single African currency made from gold, a true sharing of the wealth.

In the months leading up to the military intervention, he called on African and Muslim nations to join together to create this new currency that would rival the dollar and euro. They would sell oil and other resources around the world only for gold dinars.